California’s divided housing market, as told by 2 maps

Fast CompanyWant more stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the free, daily ResiClub newsletter.

At the height of the pandemic housing boom, this 5-bedroom house in Oakland, California, sold for a whopping $4.1 million in March 2022.

Fast-forward to January 2024, and the home was listed for sale again at close to $3 million, or about 27% below the March 2022 sale price. That lower price tag doesn’t appear to be an agent tactic, given that on April 1, 2024, the price was cut to $2.55 million. This latest price tag is nearly 38% below its March 2022 sale price; however, it still remains almost 46% above its November 2020 sale price of $1.75 million.

While national home prices are essentially hovering around all-time highs, some pockets of the country, especially at the higher-price tiers, have fallen from their frothy peaks in spring 2022. And that’s the case in the California housing market.

Look no further than the 94610 ZIP code in Oakland—the location of the home above—where home prices have dropped by 16.7% from their 2022 price peak and by 4.4% on a year-over-year basis, according to ResiClub’s analysis of the Zillow Home Value Index.

Why are home prices down in Oakland’s 94610 ZIP code? Let’s take a deep look at California home prices.

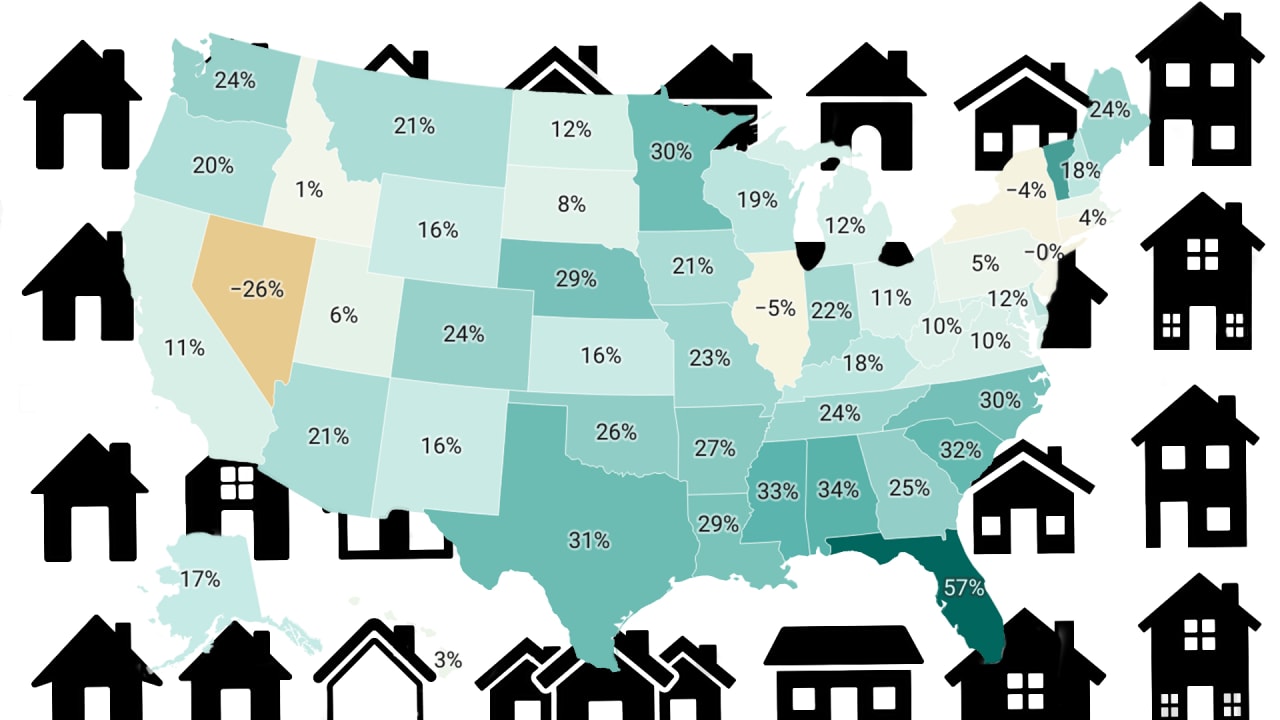

Click here to view an interactive/zoomable version of the map below.

This first analysis by ResiClub above shows that home prices across much of Northern California, particularly in markets like San Francisco and Oakland, remain below their 2022 price peak. Meanwhile, many parts of Southern California, particularly in San Diego and Los Angeles, are at or just above their 2022 price peak.

Before we get into why this is happening, let’s look at just the past 12 months in California.

The second analysis by ResiClub below shows that home prices in most of California have remained flat or have increased over the past 12 months. Additionally, in some markets such as San Diego and Los Angeles, the year-over-year home price jump between February 2023 and February 2024 has been fairly significant.

Click here to view an interactive/zoomable version of the map below.

So what exactly has happened in California’s housing market since spring 2022?

As mortgage rates spiked from 3% to over 6% in 2022, housing markets across much of the Western half of the country—where price-to-rent ratios were strained and buyers were already stretching themselves thin to enter the market—slipped into home-price-correction mode as affordability became too burdensome for many buyers out West. However, as mortgage rates stabilized entering 2023 and resale inventory began to fall, many Western housing markets began to stabilize, and home prices began to rise again in some Western/Californian markets. This 2023 jump was significant enough in most parts of Irvine and San Diego to erase all of the price declines that occurred in the second half of 2022.

While home price declines have also slowed or reversed in Northern California, including markets like Oakland, most Northern California markets are still below the 2022 price peak. One theory for the divergence between Northern and Southern California is the interest-rate-sensitive tech sector, which dominates up north. While the AI boom has boosted things over the past 12 months, much of the sector is still adjusting to the higher interest rate environment. In other words, housing markets in San Francisco and Oakland are feeling the absence of those IPOs.