Rising housing market inventory isn’t hurting builders yet, says CEO of America’s largest homebuilder

Fast CompanyWant more stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the free, daily ResiClub newsletter.

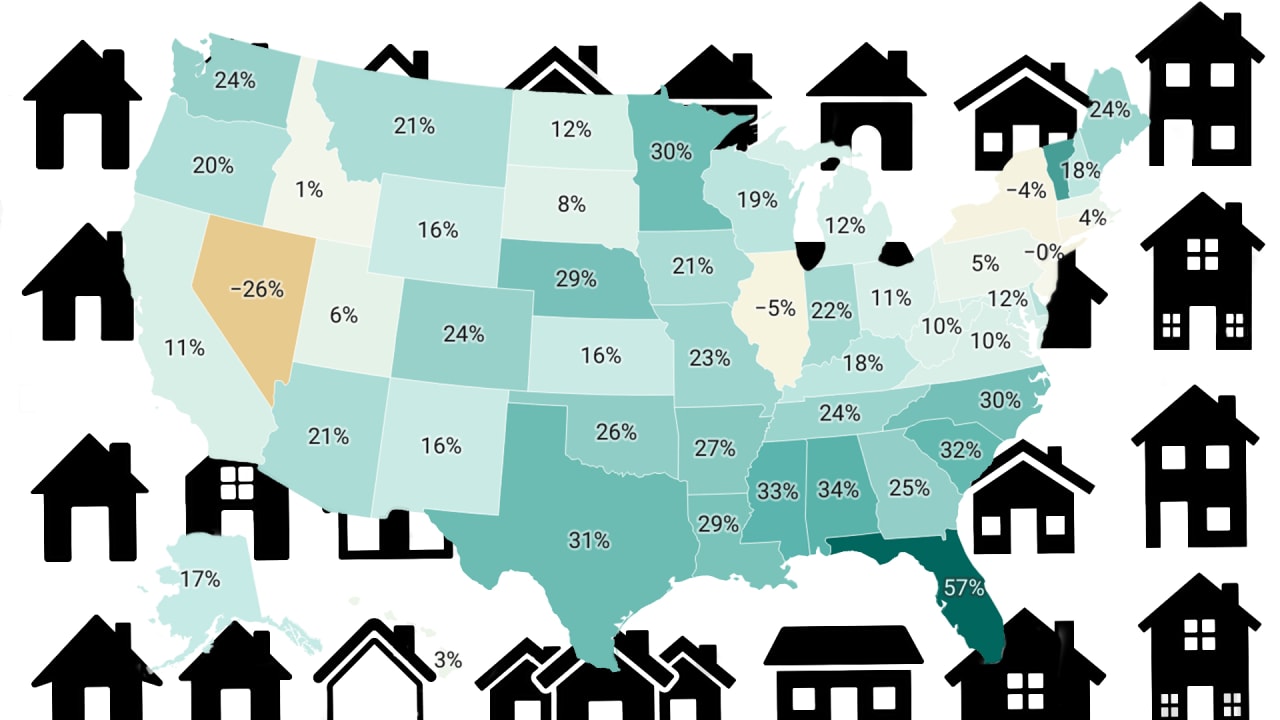

On the company’s most recent earnings call, an analyst asked D.R. Horton CEO Paul Romanowski how the nation’s rising housing market inventory—which in March 2024 was 24% higher than March 2023, although still 37.7% below March 2019—are impacting the nation’s largest homebuilder.

Romanowski acknowledged that there’s more housing market inventory today than there has been in the past. “Months of supply has crept up slowly across most of our markets,” he said. But he maintained that the majority of that inventory is overpriced, needs significant improvements, or otherwise is “not in the affordable price points where we tend to compete,” he said. “So we expect it’s going to take significantly more homes to come on before we see [a lot] of impact on our ability to sell.”

Click here to view an interactive version of the map below.

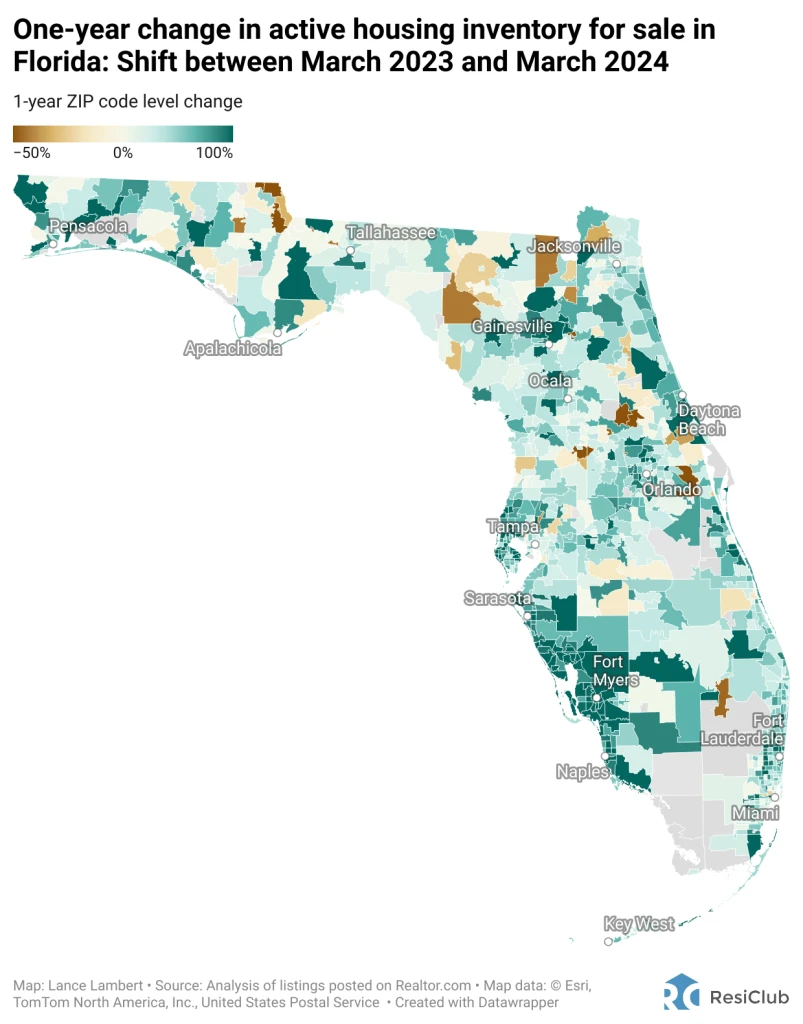

Another analyst asked Romanowski specifically about rising housing market inventory in Florida, which is up 57% on a year-over-year basis.

Romanowski said the company still felt good about Florida. “There certainly has been a lot of news tied to the rise in insurance rates and for most of where we sell our homes are off the coast and building new construction allows for some stability in those insurance rates,” he noted. “So [we] haven’t seen a significant increase for the homes in the communities where we sell as you may see reported along the coastal and high wind zones. Still seeing good migration and good job growth throughout the Florida market. So we feel pretty good about the Florida market and especially about our positioning at the more affordable price points across the Florida Peninsula.”

Click here to view an interactive version of the map below.

Bill Wheat, CFO of D.R. Horton, was asked during the call whether the recent increase in mortgage rates would lead the homebuilder to allocate more funds towards mortgage rate buydowns in the current quarter, a tactic homebuilders have used to entice homebuyers amid rising interest rates.

“We move our [buydown] rates along with the market,” said Wheat. “It really just starts to stress the buyer when they climb up into the 7% and if they go to the 8% range, then we’ll see a little more challenge in getting buyers qualified. And if it goes that high, I would expect to see our incentives increase to keep our pace.”

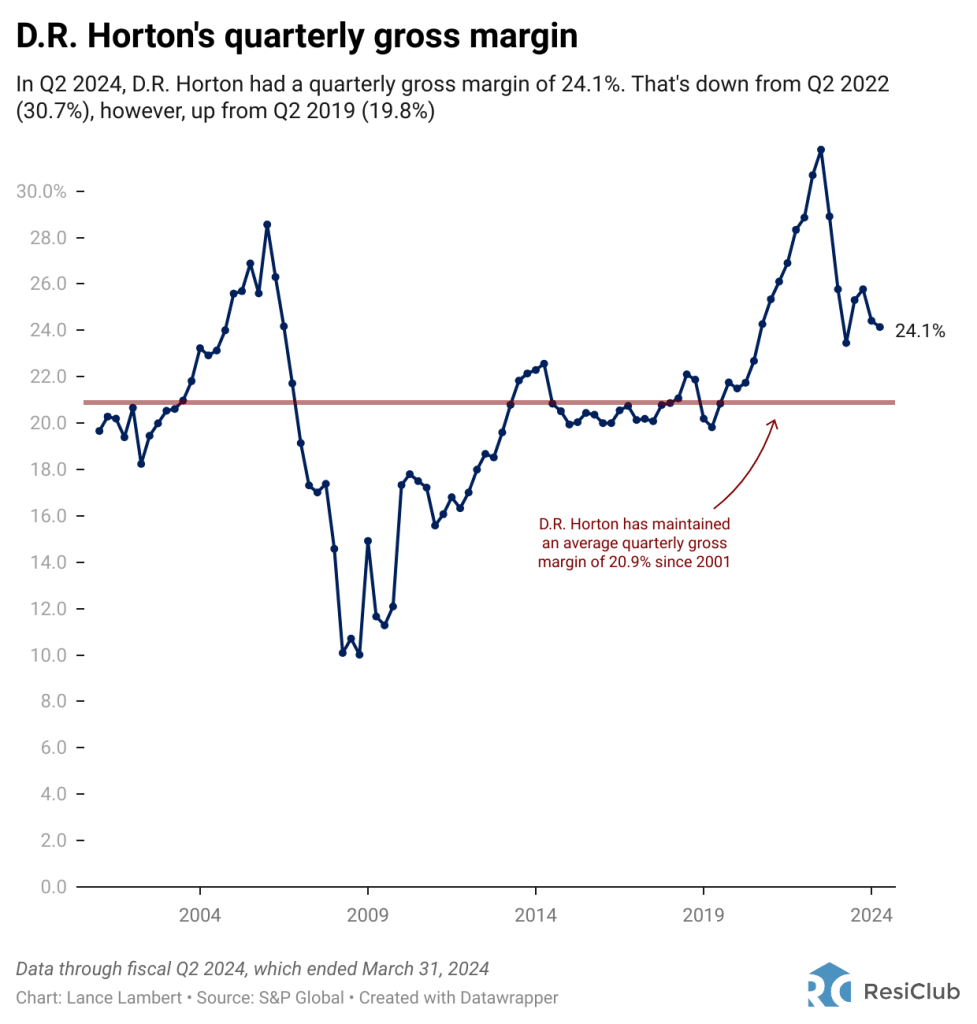

Despite continuing to offer costly incentives like mortgage rate buydowns, D.R. Horton notched a gross margin of 241.% in fiscal Q2 2024, according to S&P Global. While that represents some margin compression since Q2 2022 (30.7%), it’s still above the pre-pandemic level of Q2 2019 (19.8%).

“We feel like it’s sort of—I won’t say business as usual in this crazy volatile world we’re in. But right now, we feel pretty steady, pretty good about where things are,” Romanowski, D.R. Horton’s CEO, said on the call.

Click here to view an interactive version of the chart below.

Two years ago, institutional capital slowed its deployment into the housing market as rates spiked. An analyst asked D.R. Horton COO Mike Murray if the company is observing a resurgence in investor purchases from D.R. Horton.

“I would say we’ve seen a little bit of a tick up in terms of interest and the number of investors out there in the market. They’re still being cautious and rates are where they are,” Murray responded. “But I would say that just across the board, we’ve seen a bit of a tick up and have more interested parties in those assets that we have out for sale today.”