2 weeks Best Real Estate Investment Markets in Texas Benzinga

The post Best Real Estate Investment Markets in Texas by Jordan Robertson appeared first on Benzinga. Visit Benzinga to get more great content like this.

Thanks to its booming economy, business-friendly policies, and steady population growth, Texas has emerged as a top destination for real estate investors. Known for its affordable housing, diverse industries, and high demand for rental properties, the Lone Star State offers opportunities for both short-term profits and long-term gains. Cities like Austin, Dallas, Houston, and San … Continued

The post Best Real Estate Investment Markets in Texas by Jordan Robertson appeared first on Benzinga. Visit Benzinga to get more great content like this.

2 weeks Stock market retreat in Trump’s first 100 days is among worst starts for a president in almost a century Fortune

In President Joe Biden’s first 100 days, the S&P 500 surged more than 9%. Under Trump, it’s tanked almost 8%.

2 weeks 2025 Spring Investment Directions: Exposures For Volatile Markets Seeking Alpha

2 weeks Trump’s tariffs fueled unhealthy uncertainty, but soon markets will ‘settle down,’ says Goldman CEO David Solomon Fortune

CEOs are tightening their belts because of the current market uncertainty, Solomon said.

2 weeks Wall Street choppy as markets juggle trade war news, mixed earnings Investing.com

2 weeks Robinhood Set to Report Q1 Earnings: Here’s How to Play HOOD Stock Zacks

HOOD is set to announce its first-quarter 2025 results tomorrow. Do its diversification efforts make it a solid bet, or do tariff concerns dent its prospects?

2 weeks Tomasz Tunguz: Secondaries as the new IPO is no passing fad—it’s a VC evolution Fortune

VC secondary activity now nearly equals the private equity market and is set to grow significantly.

2 weeks Is a Beat in the Cards for Cboe Global This Earnings Season? Zacks

CBOE’s Q1 results are likely to reflect solid index options growth, disciplined expense management and healthy trading volumes.

2 weeks UPS to cut 20,000 jobs on lower Amazon shipments, profit beats estimates Reddit

https://www.reuters.com/markets/us/ups-reports-fall-first-quarter-revenue-2025-04-29/ April 29 (Reuters) – United Parcel Service said on Tuesday it will cut 20,000 jobs and shut 73 facilities to lower costs in an uncertain economy. Such a significant …

2 weeks Baron Emerging Markets Fund Q1 2025 Top Contributors And Detractors Seeking Alpha

2 weeks Barrons: Why Trump’s Next 100 Days Will Be More Crucial for Stock Markets and 5 Other Things to Know Today. Reddit

While the first 100 days of Donald Trump’s Presidency have been dismal for stock markets, the next 100 could be crucial-and things are starting to look brighter. The S&P 500 has fallen 7.8% since Trump took office in January—on track for the worst …

2 weeks Markets Hold Their Breath Seeking Alpha

2 weeks Live Nasdaq Composite: Markets Stand Still on Tariff and Tech Tussle 24/7 Wall St.

Live Updates Live Coverage Updates appear automatically as they are published. Consumer Weakness 11:03 am by Gerelyn Terzo The stock market averages are currently all moving higher despite some weaker than anticipated economic data. The U.S. consumer has long been credited with upholding the economy throughout the one-two punch of inflation and higher interest rates. Now […]

The post Live Nasdaq Composite: Markets Stand Still on Tariff and Tech Tussle appeared first on 24/7 Wall St..

2 weeks ‘Trump chickened out’: Chinese social media mocks Trump on trade Reddit

Good to see the US equity markets in the green for the *past 5 sessions! USA is back! Or not? Few possible reasons for the positive sessions in equities over the past few trading days: (1) Fed Put more likely to happen sooner rather than later, ie inte…

2 weeks #GoldmanSachs CEO #Solomon says #markets will ‘settle down’ after disorder YouTube

2 weeks Got $5,000: These Dividend Stocks Trade at a 52 Week Low 24/7 Wall St.

If you have an extra $5,000 to invest, you may want to consider beaten-down dividend stocks currently trading at a 52-week low. Not only can you benefit from their higher yields, but you have an opportunity to cash in on the stock’s recovery, too. Plus, with markets still volatile, one of the best ways to […]

The post Got $5,000: These Dividend Stocks Trade at a 52 Week Low appeared first on 24/7 Wall St..

2 weeks Staying invested beats selling in volatile markets, says Wells Fargo Investing.com

2 weeks 4 Value Stocks With High Earnings Yield to Buy Now Zacks

Unlock your portfolio value with high earnings yield stocks like EQX, NATL, ASLE and QFIN.

2 weeks JPY underperforming along with haven peer CHF – Scotiabank FXStreet

The Japanese Yen (JPY) weakened by 0.5% against the dollar, underperforming even fellow haven currencies, as markets brace for soft domestic data and upcoming US-Japan trade negotiations.

2 weeks EUR: ECB CPI expectations surprise w/ markets still pricing June cut – Scotiabank FXStreet

Euro (EUR) is soft, down 0.3% against the US Dollar (USD) and a mid-performer among the G10 in an environment of broad-based USD strength, Scotiabank’s Chief FX Strategist Shaun Osborne notes.

2 weeks El-Hillow: We’ve seen a broadening out in the markets YouTube

2 weeks The Zacks Analyst Blog Highlights Dream Finders, Primoris, PotlatchDeltic, Martin Marietta Materials and MasTec Zacks

Dream Finders, Primoris, PotlatchDeltic, Martin Marietta Materials and MasTec are included in this Analyst Blog.

2 weeks ‘Trump is trying to break us’: What to expect from Mark Carney, Canada’s new PM Fortune

Also: Trump’s approval rating at his 100th day in office is at an historic low, more US consumers are buying groceries but paying later

2 weeks Gold flirts with 1% loss on Tuesday while markets see tariff fears have peaked FXStreet

Gold price (XAU/USD) is seeing buyers and sellers being pushed towards each other as Bullion gears up for a breakout, currently trading around $3,313 at the time of writing on Tuesday.

2 weeks USD: A few days of key data ahead – ING FXStreet

The US Dollar’s underwhelming start of the week served as a reminder that even if the worst of the confidence crisis on the dollar’s reserve value may be past us, markets remain very much minded to link the greenback’s faith with US economic performanc…

2 weeks Stocks Churn After Weak Data as Earnings Roll In: Markets Wrap Yahoo Finance

2 weeks Global Markets Steady Amid Company Earnings, Trade Uncertainty Yahoo Finance

2 weeks Hedge funds venture back to markets to buy bank shares, says Goldman Sachs Yahoo Finance

2 weeks Markets Buoyed By News On Trade Talks And The Fed Chair Seeking Alpha

2 weeks Longest foreign buying spree in nearly two years powers Indian markets Investing.com

2 weeks KKR and Capital Group seek to lure investors to private markets with new funds Financial Times

Strategies will span loans, corporate buyouts, and infrastructure and property deals

2 weeks Politics And The Markets 04/29/25 Seeking Alpha

2 weeks Trump First 100 days ending April 29, 2025, it’s make or break for the Markets Reddit

We’re now 100 days (or 10000 days?) into Mr. T’s second term—a pivotal moment. It's been a marathon already, and this week feels especially significant. The administration's next moves will reveal how seriously they plan to tackle policies that…

2 weeks U.S. tariffs will hasten, not slow, China’s drive for tech self-sufficiency Fortune

The next time the U.S. tries something like the H20 chip ban, it may mean very little to the China AI ecosystem.

2 weeks It’s easy to be negative about the markets right now, says Jim Cramer YouTube

2 weeks Rebecca Patterson says markets could see big outflows from foreign investors out of U.S. assets YouTube

2 weeks Markets Fight Back to Flattish; Q1 After the Close: FFIV, CDNS & More Zacks

Today saw a mid-day dip across major indexes, but rebounded into the green by the end of the session — all but the tech-heavy Nasdaq.

2 weeks US stocks closed mixed, navigating volatile markets, signs of an economic slowdown. YouTube

2 weeks A Farm-to-Table Pioneer Leaves a Legacy of Innovation Inc.com

Barry Benape, a city planner who came from a family of farmers, created the largest network of farmers’ markets in the nation.

2 weeks US Dollar strugguling as markets await GDP and employment data FXStreet

The US Dollar (USD) weakens slightly on Monday as markets kick off a busy week, overshadowed by skepticism surrounding United States (US) trade policy.

2 weeks AUD/USD defends its ground as markets await US data, Aussie inflation FXStreet

The AUD/USD pair is trading steadily around 0.6400 as investors brace for key economic data from the United States (US) this week.

2 weeks Deliveroo shares surge following DoorDash’s $3.6 billion proposed takeover Fast Company

Shares of Deliveroo, the food delivery service based in London, are hitting three-year highs on Monday after it received a $3.6 billion proposed takeover offer from DoorDash.

Deliveroo announced the bid after markets closed in Europe on Friday. On …

2 weeks EMD: The Case For This Emerging Markets Debt Fund Is Weakening Seeking Alpha

2 weeks Buyer’s or seller’s housing market? Zillow’s analysis for 250 markets Fast Company

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

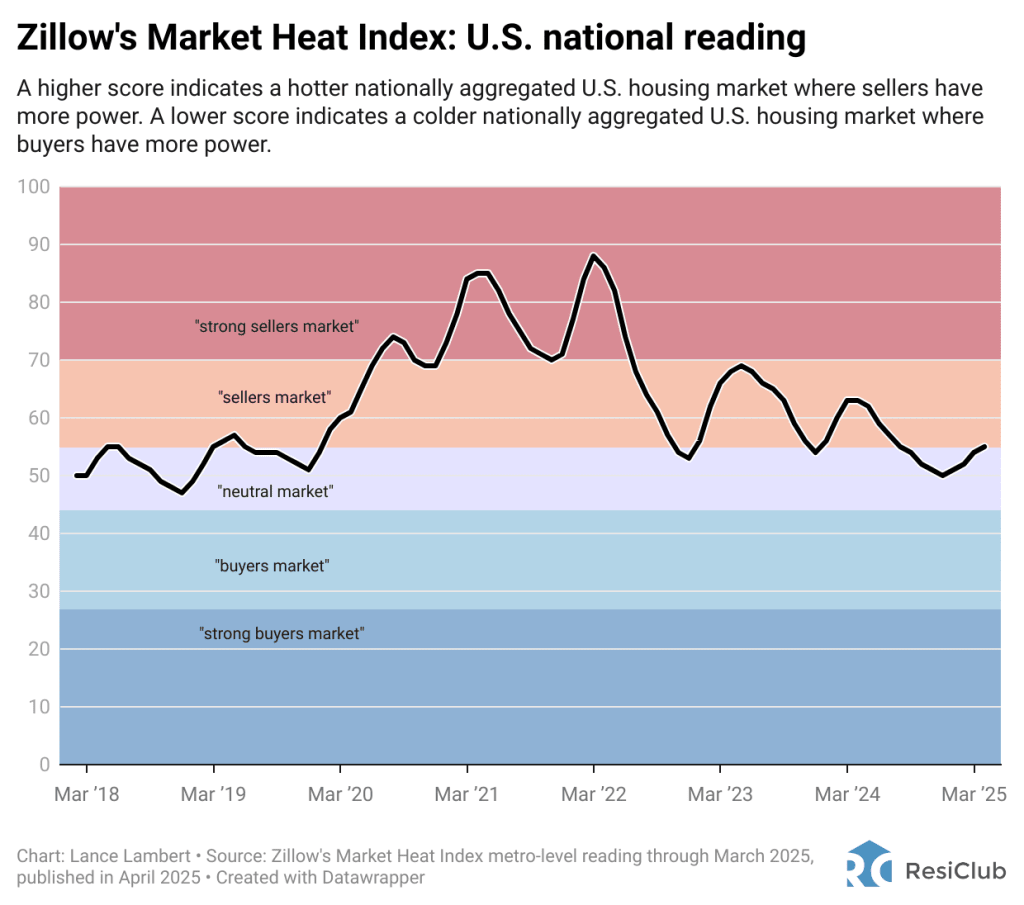

Zillow economists use an economic model known as the Zillow Market Heat Index to gauge the competitiveness of housing markets across the country. This model looks at key indicators—including home price changes, inventory levels, and days on market—to generate a score showing whether a housing market favors sellers or buyers.

Higher scores point to hotter, seller-friendly metro housing markets. Lower scores signal cooler markets where buyers hold more negotiating power.

According to Zillow, a score of 70 or above means it’s a “strong sellers market,” and a score from 55 to 69 is “sellers market.” A score from 44 to 55 indicates a “neutral market.” Meanwhile, a score from 28 to 44 is a “buyers market” and 27 or below is a “strong buyers market.”

Nationally, Zillow rates the U.S. housing market at 55 in its February 2025 reading, published in March 2025.

That said, Zillow’s reading varies significantly across the county.

Among the 250 largest metro area housing markets, these 10 are the hottest markets, where sellers have the most power:

- Rochester, NY: 185 rating

- Buffalo, NY: 128

- Syracuse, NY: 102

- Hartford, CT: 99

- Charleston, WV: 97

- Albany, NY: 95

- Manchester, NH: 92

- Ann Arbor, MI: 92

- Poughkeepsie, NY: 91

- Boston, MA: 89

And these are the 10 coldest markets, where buyers have the most power:

- Jackson, TN: 16 rating

- Gulfport, MS: 24

- Brownsville, TX: 26

- Macon, GA: 26

- Daphne, AL: 27

- Beaumont, TX: 28

- Naples, FL: 28

- Cape Coral, FL: 30

- Panama City, FL: 30

- Punta Gorda, FL: 32

Directionally, I believe Zillow has correctly identified many regional housing markets where buyers have gained the most power—particularly around the Gulf—as well as markets where sellers have maintained (relatively speaking) somewhat of a grip, including large portions of the Northeast and Midwest.

Based on my personal housing analysis, I consider Southwest Florida the weakest/softest chunk of the U.S. housing market, followed by Texas markets around Austin and San Antonio.

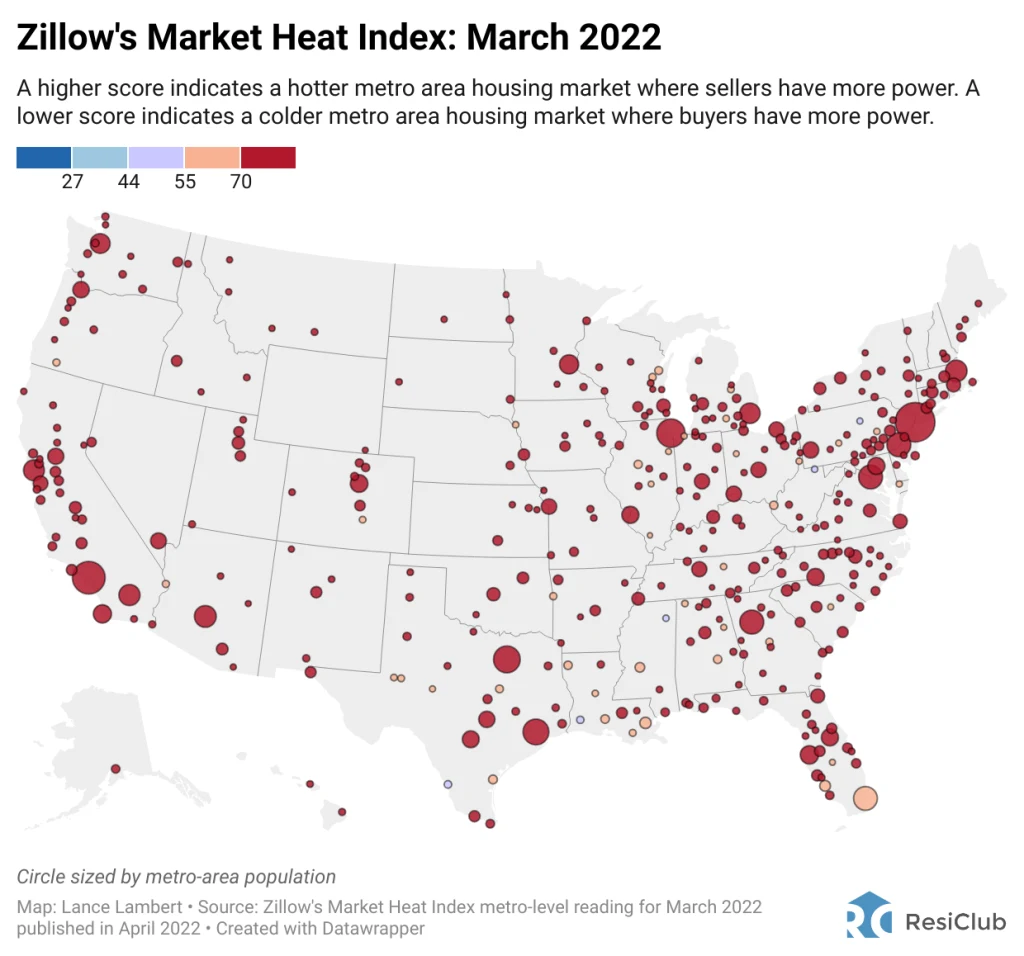

What did this Zillow analysis look like back in spring 2022 at the climax of the pandemic housing boom? Below is Zillow’s March 2022 reading—published in April 2022.

2 weeks After 100 Days in Office, the Stock Market’s ‘Trump Bump’ Has Become a Trump Slump Money.com

All the stock market gains from the post-election Trump bump have been erased.

2 weeks Wall Street holds steady as investors brace for a high-stakes week Fast Company

U.S. stocks are drifting Monday ahead of potential flashpoints looming later in the week that could bring more sharp swings for financial markets.

The S&P 500 was virtually unchanged in morning trading, coming off a winning week&…

2 weeks Biggest risk to markets is a fragmented world, says Norway wealth fund CEO Yahoo Finance

2 weeks China’s Huawei Develops New AI Chip, Seeking to Match Nvidia – Markets turn lower Reddit

https://www.wsj.com/tech/chinas-huawei-develops-new-ai-chip-seeking-to-match-nvidia-8166f606 “Huawei Technologies is gearing up to test its newest and most powerful artificial-intelligence processor, which the company hopes could replace some higher-en…

2 weeks European markets mostly higher as investors weigh earnings, trade tensions Investing.com

The Stock Market News

The Stock Market News is a financial news aggregator for traders and investors that proposes to you the latest breaking news headlines on global financial markets, economy and business. Live qoute and chart technical analysis, opinion, price forecast on current stock market, currencies (Forex), cryptocurrency, commodities futures, ETFs, funds, bonds and more. Disclaimer: by using any material of this website, you acknowledge and agree that TheStockMarketNews.com is not responsible for the content, actions or any legal issues arising from third-party websites; materials of this website are not financial advice or call to actions. Trading and investing in financial instruments involve high risks including the risk of investment loss.