1 week Markets recover from GDP ‘shock’ as tech earnings assuage economic concerns FXStreet

US stock markets staged an impressive recovery on Wednesday, after initially falling sharply on the back of a weaker than expected Q1 GDP report.

US stock markets staged an impressive recovery on Wednesday, after initially falling sharply on the back of a weaker than expected Q1 GDP report.

Retail brokerage sees record-breaking net deposits, more subscribers to its premium services, higher options volume and “robust” growth in trading across all asset classes.

Major earnings later Wednesday will be closely watched by Wall Street: Qualcomm, Meta, and Microsoft all report after the bell.

Copper prices more than doubled their losses for the month of April in a single trading session Wednesday. If the industrial metal is a leading indicator of economic activity, that doesn’t bode well for copper’s outlook, financial markets or the health…

Renewed buying interest prompted the US Dollar to add to Tuesday’s gains, always on the back of alleviating concerns over US-China trade effervescence and investors’ assessment of weaker-than-expected US data releases. Most markets will be closed on Ma…

Live Updates Live Coverage Updates appear automatically as they are published. Tariffs in the Crosshairs 12:46 pm by Gerelyn Terzo President Trump says that the Trump stock market isn’t his, instead calling out the Biden Administration for “overhang” — not tariffs — that led to negative GDP growth. The president also advised Americans to stay […]

The post Live Vanguard IT ETF (VGT): Markets Embroiled in Selling amid Economic Slowdown appeared first on 24/7 Wall St..

Dow falls more than 750 at one point.

In markets and politics, it will be more short-termist, less resilient and much more reliant on the kindness of strangers

With ADP coming in half of what was expected and Q1 GDP -0.3%, we can understand the downward pressure in the pre-market.

Many ETFs that track foreign markets are up more than 20% this year.

The post These World Markets Are Trouncing The U.S. And Tariffs Aren't The Only Reason appeared first on Investor's Business Daily.

Stock markets look likely to open lower on Wednesday, and this time it might stick, interrupting a six-straight-day winning streak for the S&P 500 and its tracking index, the Vanguard S&P 500 ETF (NYSEMKT: VOO). Both the index and the ETF are trending towards a 0.9% decline in pre-market trading after the U.S. Commerce Department […]

The post Stock Market Live April 30th: US Economy Slows, S&P 500 (VOO) Falls appeared first on 24/7 Wall St..

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Speaking to investors earlier this month, D.R. Horton CEO Paul Romanowski said that the spring 2025 selling season for America’s-largest homebuilder is off to a slower-than-normal start.

“This year’s spring selling season started slower than expected as potential homebuyers have been more cautious due to continued affordability constraints and declining consumer confidence,” Romanowski said on the company’s earnings call.

It isn’t just D.R. Horton.

“We do not see the seasonal pickup typically associated with the beginning of the spring selling season,” Lennar co-CEO Jon Jaffe told investors on March. “So we continue to lean into our machine focusing on converting leads and appointments and adjusting incentives as needed to maintain sales pace. These adjustments came in the form of mortgage rate buydowns, price reductions, and closing cost assistance.”

Last quarter, Lennar spent the equivalent of 13% of home sales on buyer incentives—up from 1.5% in Q2 2022 at the height of the pandemic housing boom. A 13% incentive on a $400,000 home translates to $52,000 in incentives.

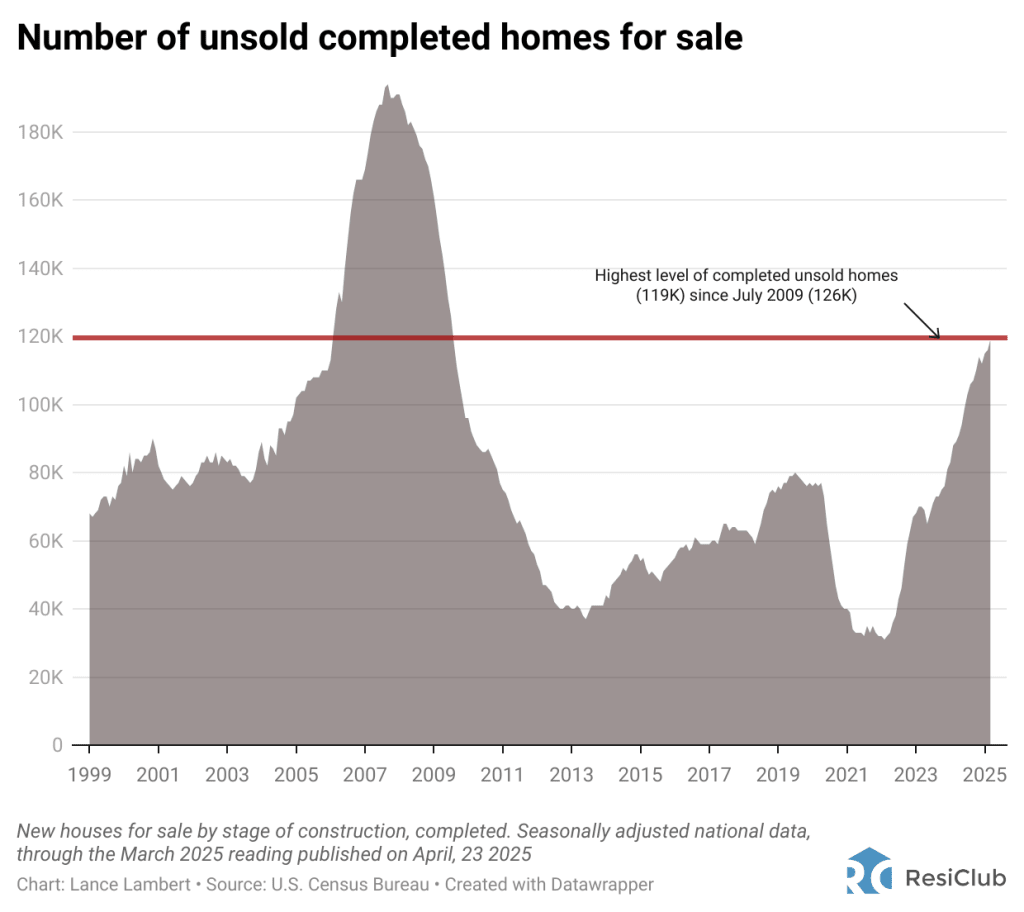

This weaker housing demand environment is causing unsold inventory to tick up. Indeed, since the pandemic housing boom fizzled out, the number of unsold completed U.S. new single-family homes has been rising:

March 2018: 62,000

March 2019: 77,000

March 2020: 76,000

March 2021: 34,000

March 2022: 32,000

March 2023: 70,000

March 2024: 89,000

March 2025: 119,000

The March 2025 figure (119,000 unsold completed new homes) published this month is the highest level since July 2009 (126,000). Let’s take a closer look at the data to better understand what this could mean.

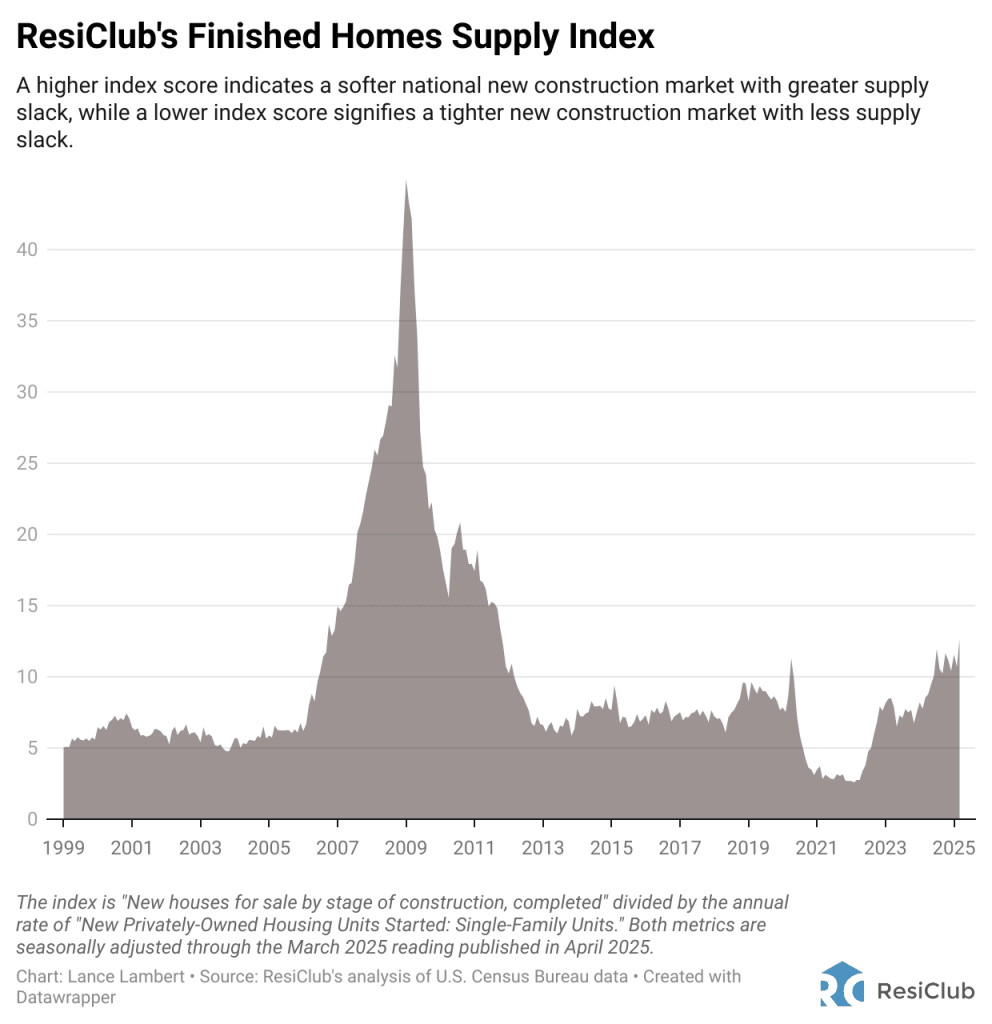

To put the number of unsold completed new single-family homes into historic context, we created a new index: ResiClub’s Finished Homes Supply Index.

The index is one simple calculation: The number of unsold completed U.S. new single-family homes divided by the annualized rate of U.S. single-family housing starts.

A higher index score indicates a softer national new construction market with greater supply slack, while a lower index score signifies a tighter new construction market with less supply slack.

If you look at unsold completed single-family new builds as a share of single-family housing starts (see chart below), it still shows we’ve gained slack; however, it puts us closer to pre-pandemic 2019 levels than the Great Recession of 2007–2009.

While the U.S. Census Bureau doesn’t give us a greater market-by-market breakdown on these unsold new builds, we have a good idea where they are based on total active inventory homes for sale (including existing homes) that have spiked above pre-pandemic 2019 levels. Most of those areas are in the Sun Belt around the Gulf.

Builders are facing pricing pressure in some housing markets, especially in key Florida and Texas markets, where active inventory has jumped back above pre-pandemic 2019 levels.

Big picture: There’s greater slack in the new construction market now than a few years ago, giving buyers some leverage in certain markets to negotiate better deals with homebuilders.

Old-school and new-age data points to economic uncertainty ahead.

Tradeweb (TW) delivered earnings and revenue surprises of 1.18% and 0.51%, respectively, for the quarter ended March 2025. Do the numbers hold clues to what lies ahead for the stock?

Goldman Sachs strategist Vickie Chang is not convinced the S&P 500’s tariff-induced wild days are over yet.

In recent days new data has shown a drastic reduction in export shipping from China to the U.S. and investors appear to have reacted as a result.

Affirm Holdings, Block, BILL Holdings and Atlassian are included in this Analyst Blog.

Home Depot, CME, Airbnb and Park Aerospace are included in this Analyst Blog.

Visa, Starbucks, Booking Holdings and Seagate are included in this Analyst Blog.

Also: Bond investors were unimpressed by a White House meeting with Trump advisor Stephen Miran, CEOs are giving up on guidance.

The Gold price (XAU/USD) extends the decline to near $3,315 during the early Asian session on Wednesday. The precious metal edges lower amid easing trade tensions and better risk sentiment in global markets.

Volatility ruled over financial markets during President Donald Trump’s first 100 days back in office, whipsawing investors across asset classes.

Wealth managers say the surging stock market in 2024 supercharged wealth creation at the top, following already sizable gains the prior year. Together, those two years made for the S&P 500’s best consecutive years in a quarter-century. (Markets hav…

Trend poses ‘much bigger threat’ to region’s capital markets than defections of listed groups to Wall Street, says report

Last month, Brett Adcock, founder of robotics startup Figure AI, claimed in a post on X that his company “is now # 1 most sought-after private stock in the secondary market.” But the company has sent cease-and-desist letters to at least two…

Kenny Polcari breaks down everything you need to know as markets brace for a massive week of earnings, key economic data, and geopolitical uncertainty.

Despite the recent rebound, President Trump’s first 100 days in office have been marked by extreme volatility.

The post Best Real Estate Investment Markets in Texas by Jordan Robertson appeared first on Benzinga. Visit Benzinga to get more great content like this.

Thanks to its booming economy, business-friendly policies, and steady population growth, Texas has emerged as a top destination for real estate investors. Known for its affordable housing, diverse industries, and high demand for rental properties, the Lone Star State offers opportunities for both short-term profits and long-term gains. Cities like Austin, Dallas, Houston, and San … Continued

The post Best Real Estate Investment Markets in Texas by Jordan Robertson appeared first on Benzinga. Visit Benzinga to get more great content like this.

In President Joe Biden’s first 100 days, the S&P 500 surged more than 9%. Under Trump, it’s tanked almost 8%.

CEOs are tightening their belts because of the current market uncertainty, Solomon said.

The Stock Market News is a financial news aggregator for traders and investors that proposes to you the latest breaking news headlines on global financial markets, economy and business. Live qoute and chart technical analysis, opinion, price forecast on current stock market, currencies (Forex), cryptocurrency, commodities futures, ETFs, funds, bonds and more. Disclaimer: by using any material of this website, you acknowledge and agree that TheStockMarketNews.com is not responsible for the content, actions or any legal issues arising from third-party websites; materials of this website are not financial advice or call to actions. Trading and investing in financial instruments involve high risks including the risk of investment loss.